Structuring a Syndication & 1031 Exchange

Published April 15th, 2019

Note to readers: this blog post has been adapted from a forthcoming book I am writing on 1031 exchanges. Many of the topics that this post mentions in passing will have been covered in great detail in previous chapters.

One of the most common questions I get is about how to purchase a property with some of the funds coming from a 1031 exchange and the balance from syndication. It is an advanced topic, and one that brings a host of considerations and risks to all parties: the exchangor, the syndicator, and the limited partners. In this chapter I will outline the structure and several of the considerations.

Disclaimer: this chapter is written with the 1031 exchangor's interests in mind, but is general information only. I am not an attorney, nor am I a tax professional; discuss with your own counsel and advisors for advice specific to your situation.

Why Typical Syndication Structure is Incompatible with Section 1031

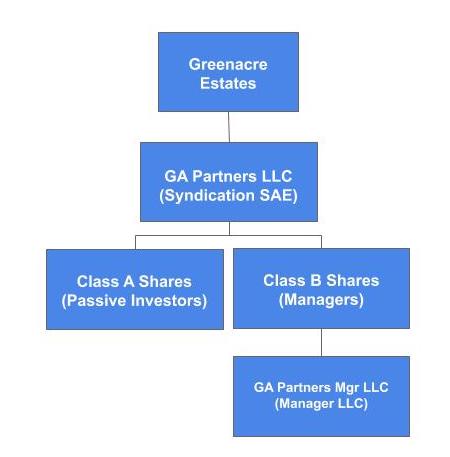

Let's start with an overview of how a typical syndication is structured, then we can see how and why it needs to be modified to accommodate a 1031 exchange.

Figure 1 shows the typical structure of the purchase and syndication of real property. Title to the asset, Greenacre Estates, is held by a single-asset entity (SAE) called GA Partners LLC. A set of limited partners invest in GA Partners LLC, purchasing Class A Shares. GA Partners LLC itself is managed by a separate manager LLC (GA Partners Mgr LLC), in which the general partners hold their interests.

At this point, you might ask, "can the exchangor simply use their exchange funds to buy shares of the SAE, like all of the investors in the syndication?"

NO!!! As previously discussed, the IRS code stipulates that a 1031 exchange is the exchange of one interest in real property for another interest in real property. The problem with using the exchange proceeds to buy shares in GA Partners LLC -- like any limited partner must do -- is that the exchangor has now exchanged their interest in real property (by selling their downleg) for shares in an LLC. Shares in a multi-member LLC are considered personal property, not real property. This would not constitute a valid 1031 exchange.

Tenancy-In-Common: 1031 + Syndication

In order to have an interest in real property, the exchangor must take title directly to their exchange upleg. One way of accomplishing this is by taking title as a tenant-in-common. When structured properly, and done with the right intentions, it is possible to use tenancy-in-common to achieve the objective of combining 1031 exchange proceeds with syndicated funds to co-purchase real property.

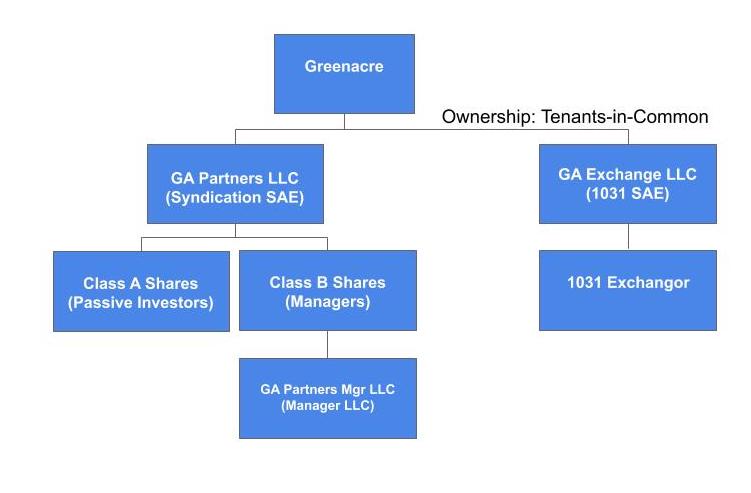

Figure 2 shows the modifications to the structure in Figure 1 necessary to accommodate the 1031 exchange. There are now two top-level SAEs (GA Partners LLC, the same as in Figure 1, and GA Exchange LLC, a new entity) that hold title to the asset, Greenacre, as tenants-in-common. It is common to refer to these top-level SAEs that take title as tenants-in-common as "TIC"s, and important to note that both TICs own a real property interest in the asset.

The first TIC is GA Partners LLC from our previous example. It, and everything underneath it remains the same as before. The second TIC, GA Exchange LLC, is for the 1031 exchange. It is wholly owned by the exchangor, whether that be an entity or natural person.

This structure accomplishes the basic goals of all parties: the syndicator has an entity through which they can take partial title to an asset and sell membership units to their limited partners; meanwhile, the exchangor can take partial title to the same asset, satisfying one of the key criteria of section 1031.

Multiple TICs

There is technically no limit to the number of parties who can take title as tenants-in-common. In practice, however, the number is limited by IRS and lender considerations. Most commercial lenders have comfort with up to five tenants-in-common. Since securing the loan is crucial to a successful close, it is highly recommended to seek the lender's approval of the structure as soon as possible. More on IRS limitations soon.

Risks and Considerations

Now that we have discussed the entity structure for accommodating a 1031 exchange alongside a syndication it is time to discuss how this structure changes the dynamics of a vanilla syndication and where some of the risks lie.

Invalidation of 1031 Exchange

Please understand: every 1031 exchange involves the risk that the IRS will deem the exchange invalid. With so many nuanced exchange scenarios, the IRS cannot bless them all, and indeed they have not: there are no Safe Harbor rulings that establish a set of steps which, if followed, will categorically be recognized as a valid exchange. The more "outside the box" of the simplest exchange one gets, the more risk there is that the IRS may not see things the way you desire.

The tenancy-in-common path outlined above introduces a new reason for the IRS to invalidate your exchange: they may deem it a partnership. Tenancy-in-Common as a way of taking title exists for a specific business purpose, and if the purchase is structured as a tenancy-in-common, the IRS will measure your actions against their yardstick to see if the parties have been behaving as tenants-in-common. If the IRS determines that the TICs are effectively acting "in partnership", they may invalidate the 1031 exchange. Therefore, I strongly urge you not to think of tenancy-in-common as a way to "get around" IRS regulations and place 1031 exchange funds into a syndication.

Exchange invalidation presents risks to all parties:

To the Exchangor: immediate recognition of gains/losses and resulting tax burden

To the Syndicator: an unhappy co-TIC which may result in lawsuits; the inability for the 1031 TIC to share in proportionate costs; or worse, the tax burden more force them to sell their interest in the property; unhappy LPs (see below)

To the Limited Partners: an unstable situation which distracts their GP and may put their investment at risk.

How precisely to act as tenants-in-common and NOT as a partnership can be a fine line, and is one that you should discuss with counsel. Here are a non-exhaustive list of suggestions.

Consider IRS Rev Proc 2002-22

In 2002, the IRS issued a set of guidelines for requesting private letter rulings about whether TIC interests in real property will be eligible for 1031 exchanges. The IRS itself warns that the guidelines are not a Safe Harbor, meaning you could follow all of them and the IRS may choose not to issue a private letter ruling. However, many tax professionals suggest following them as a best practice.

Some of the key guidelines are:

The number of tenants-in-common cannot exceed 35 (as mentioned above, usually limited to 5 by the lender)

Decisions that have material or economic impact on the property must be approved unanimously by all owners

The management agreement must be renewable annually

Owners must share profits and losses, and indebtedness, in proportion to their undivided interests

Any fees paid to the sponsor may not depend on income or profits derived from the property

Be Careful When Speaking Publicly

Never refer to the other party as your partner on the deal, especially on social media. Publicly holding yourself out as partners is something that the IRS can use as evidence against a tenancy-in-common.

Operating Accounts

It may make sense to have your property manager open an operating account, in their name, that is held in trust for the property. The alternative is to have one of the TICs open the account, but there is a risk that this would be seen as pooling funds, a characteristic of a partnership.

Greater Required Involvement

Unlike a limited partner (passive investor) in a syndication, a 1031 exchangor will have an increased and ongoing involvement in a project.

They, and all relevant entities, will be underwritten by the lender during the loan application

They will need to be involved and sign off on all material decisions, including choosing a property manager

At this point, some ask the question, "can I just assign my voting power to the syndication sponsors?" The answer is NO, because to do so would create a partnership.

Several aspects of this may be undesirable for the syndication sponsor and their investors:

increased friction to making decisions

increased logistical overhead

the sponsor may not want the 1031 TIC to have an active say in the operations of the property

the limited partners in the syndication may not know or trust the intentions and/or capabilities of the 1031 TIC owner

unlike the general partners of a syndication, the 1031 TIC owner has no fiduciary duty to the limited partners in the syndication TIC

These can be tough challenges to overcome. I have seen passive investors pull out of a syndication because of the TIC struture. I have also seen 1031 TIC owners behave passively. However, the more passive the 1031 TIC is, the more the whole thing may appear as a partnership.

TIC Misalignment

Since all TICs must decide unanimously on key issues, no one party is in control. What happens if there is a disagreement about how to run the property? What happens if one party wants to sell and the other does not?

These questions are addressed in the TIC Agreement, which the lender will require be drafted and signed (and which the Rev Proc 2002-22 says the presence of will not automatically constitute a partnership).

While the TIC Agreement provides answers to what happens? in the scenarios, the fact of the matter is: you do not want these scenarios to happen!

Let's hone in on the example where you want to sell, but the syndication sponsor does not. The TIC Agreement will likely provide that you will need to give the syndication TIC the right of first refusal to buy your interest. But the syndication entity likely does not have enough money to buy your interest -- they only raised enough money to buy their own interest and have been distributing dividends to their investors so they have little cash on hand. In this case, your only alternative is to take your interest to the open market. However, due to the concept of minority discount, you will receive less for your interest than if all TICs acted in concert to sell 100% of the property.

It's also not good from the syndication sponsor's perspective. The buyer of your interest may be someone they are less inclined to work with, or less with less aligned intentions.

Reciprocally, what if the syndication sponsor decides that now is the time to sell to maximize their investors' returns, but you want to keep holding? You may choose to sell now -- incurring the hassle of another 1031 exchange and the increased risk of a failed exchange and all of the deferred taxes becoming due -- or you may end up with a new co-owner you don't like.

Sponsor Compensation

Most sponsors want to be paid for their time in locating, underwriting, securing, and structuring a deal. They have invented menu of possible fees including: acquisition fees, disposition fees, capital event fees, asset management fees, carried interest, etc.

Many sponsors will be disappointed to learn that they cannot structure their fees the same way when dealing with a 1031 exchange TIC. In particular, carried interest and asset management fees are off the table. The main principle is one we have already discussed: to protect yourself, don't enter into any agreements that look and feel like a partnership.

Going back to Figure 2, if the 1031 TIC GA Exchange LLC were, in its operating agreement, to promise a percentage of the profits to a 3rd party like GA Partners Mgr LLC, that would look an awful lot like a partnership. This is also called out in Rev Proc 2002-22 which states in a point labeled "Payments to Sponsor: "... the amount of any payment to the sponsor ... may not depend, in whole or in part, on the income or profits derivded by any person from the Property".

Here are a few different approaches to sponsor compensation:

No Fees

The most conservative approach, recommended by many attorneys with whom I have consulted, is that the 1031 TIC should not pay any fees at all. While clean and advantageous for the 1031 TIC, many sponsors and many limited partners are not thrilled with this approach since it effectively means the 1031 TIC gets a free ride while the limited partners pay fees.

Placement Fee

It is generally possible for the 1031 TIC to pay a one-time fee at closing to the sponsor. It may be labeled as an acquisition, finder, or placement fee. Either way, it comes with its own issues.

Size of Fee Many syndication sponsors expect to earn 20-33% in compensation for each dollar of investment they raise. This is far more than they could expect someone to pay up front. Even a 5-10% up-front load may be considered unpalatable to the exchangor, and that would still represent a discount to what the syndicator is used to receiving.

Does it Appear on the Closing Statement? This fee may be a qualified exchange expense if it appears on the closing statement (consult your tax advisor and your Qualified Intermediary for more details). However, since all TICs are supposed to share proportionately in expenses, a TIC with a 33% undivided interest should only pay 33% of the acquisition fee. If the other TICs are not also paying acquisition fees and your 1031 TIC is paying 100% of the fee, then you have effectively received less equity than would be proportionate for the amount of money you put into the deal. This may cause recognition of boot. One way around this may be to pay this fee outside of escrow.

Consulting Agreements

Some sponsors have exchangors sign separate consulting agreements. I have seen agreements that call for all sorts of things: one-time payments; "success fees" based on the results of the project, etc. My caution to you is that even though this may be a separate agreement outside of the scope of the project, if the intention is to sidestep IRS regulations and create an outcome similar to a partnership, the IRS may find out and invalidate your exchange.

Advanced Techniques

There are other techniques that may be considered for extremely large exchanges ($10M+) that are beyond the scope of this book. If you are at that level, I recommend you speak with your favorite, creative real estate attorney, or we can have a chat to see if I can be of service.